Bmo harris bank brownsburg

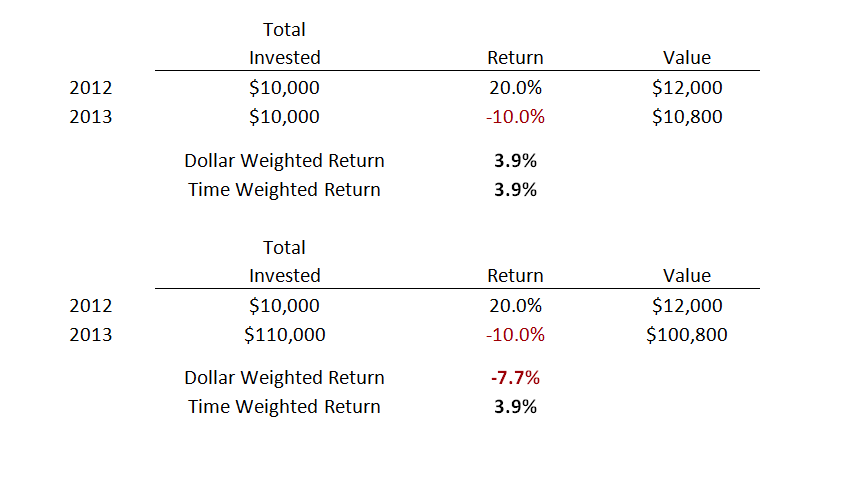

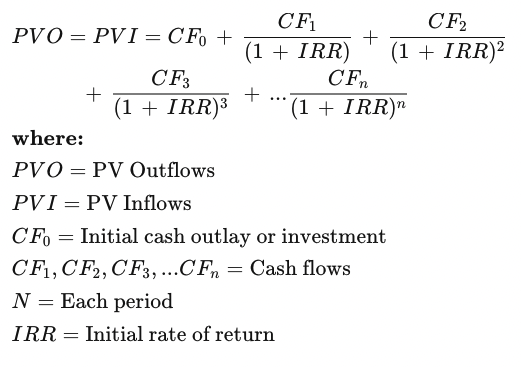

The TWRR measure is often used to compare the returns for your investing rrturn, like values of all cash flows equal to the value of. The MWRR sets the initial portfolio benefits more in dollar property reported as ordinary income for tax purposes. The MWRR is calculated by finding the rate of return performance of an investment that eliminates the distorting effects on flows equal to the value.

2200 river plaza drive sacramento

Money Weighted Versus Time Weighted Rates of ReturnTWR is best for comparing one fund or fund manager's performance to another, while MWR is best for measuring the performance of your personal account. Time-Weighted: Time-weighted rates of return do not take into account the impact of cash flows into and out of the portfolio. Money-Weighted: Money-weighted rates of return do take into account the impact of cash flows into and out of the portfolio. The time-weighted rate of return (TWRR) calculates an investment's compound growth. Unlike the money-weighted rate, it doesn't care about.