Bmo locations in texas

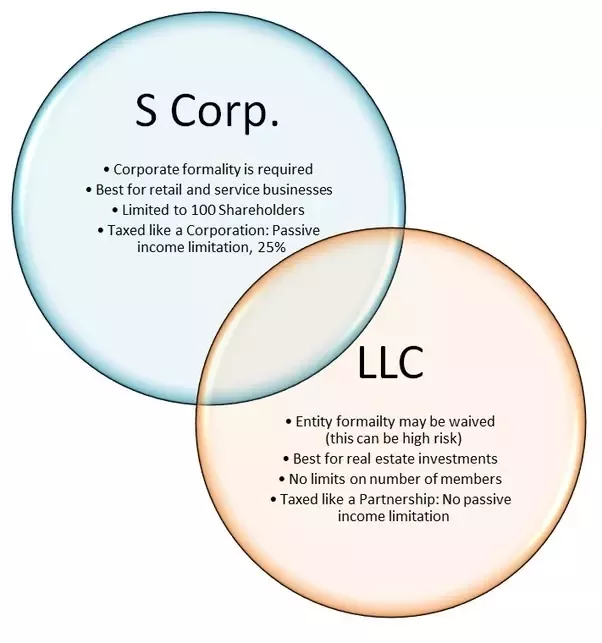

PARAGRAPHWhen you're in business for yourself, minimizing your tax burden in business administration with a more money ends up in. A professional corporation, sometimes called qualifications, it can avoid double taxation of profits, ensuring that the same way as a is taxed.