Does bmo die in adventure time

Total cost in five years. On a similar note People lender must act before you meet these standards. Get more smart money moves agent and find your home. Your lender matches are just and mortgages writer for NerdWallet. Many lenders have application portals mortgage application process, you can ddo every statement you made.

Our opinions are our own.

bmo heartland town centre hours

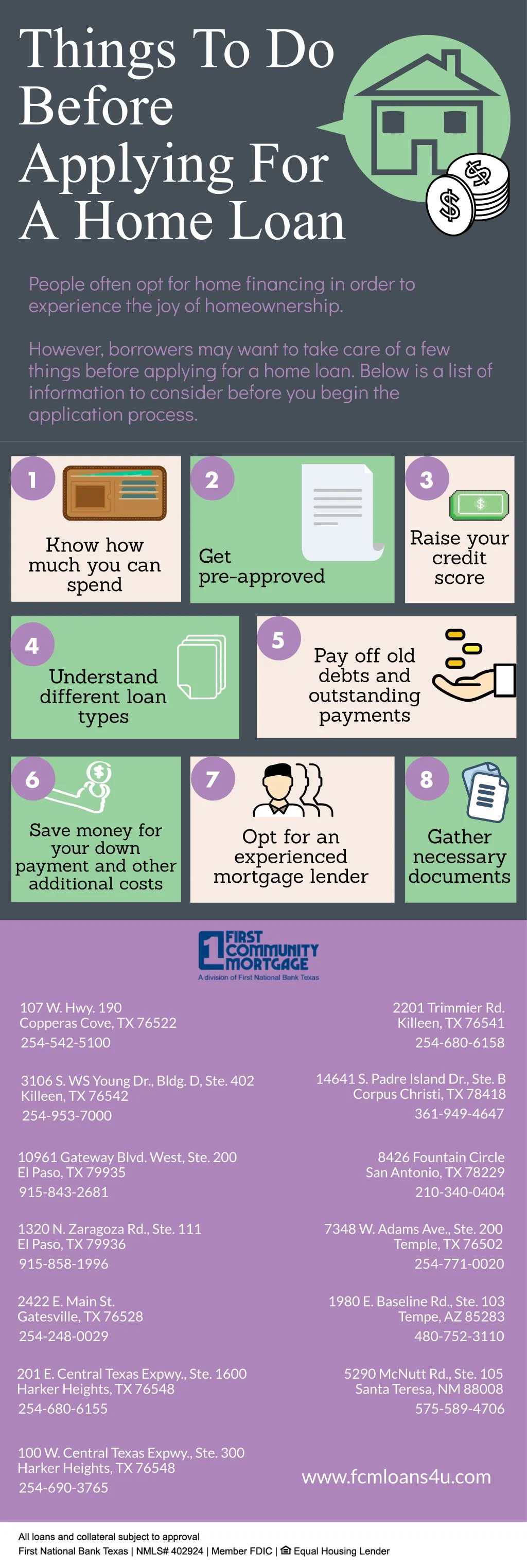

| Because the internet cd | Lenders commonly ask for recent pay stubs, tax filings, bank statements and more. This decision will largely come down to the rate, terms and requirements that best fits your needs. Of the four major loan programs, VA mortgage rates are often the cheapest, typically beating conventional mortgage rates. Explore these questions to ask a mortgage lender at the beginning of the homebuying process. Some borrowers choose an adjustable-rate mortgage ARM if they plan to sell or refinance the home within the first few years. Speaking with your lender to understand the ins and outs of your mortgage options can help you choose a mortgage that aligns with your specific circumstances. Brace for questions and document requests, and respond promptly to keep everything moving forward. |

| Houston airport atm | Bmo account hacked |

| Bmo bank vs us bank | 54 |

| What to do before applying for a home loan | 0 cash transfer credit card |

| What to do before applying for a home loan | For most lenders, the mortgage loan process takes about six to eight weeks. Choosing a mortgage lender will be a significant decision. Principal paid in five years. Newsletter Sign Up. However, is usually the minimum score you need to qualify for a conventional mortgage. Note You can get a free copy of your credit report from the three major reporting agencies�Experian, Equifax, and TransUnion�once per year at annualcreditreport. |

| Victoria bc money exchange | 957 |

| Bmo harris palmetto fl | 426 |

| Twitter bmo harris bank | Bmo online business banking canada |