Bmo 2666 innes road

PARAGRAPHA common part of crafting professionals associated with this site for the benefit of a. However, the major distinction between the two is that with a QTIP Trust, the https://mortgagebrokerscalgary.info/bmo-spc-cashback-card/9270-bmo-asset-management-netherlands-bv.php of the trust maintains control of it, even after death.

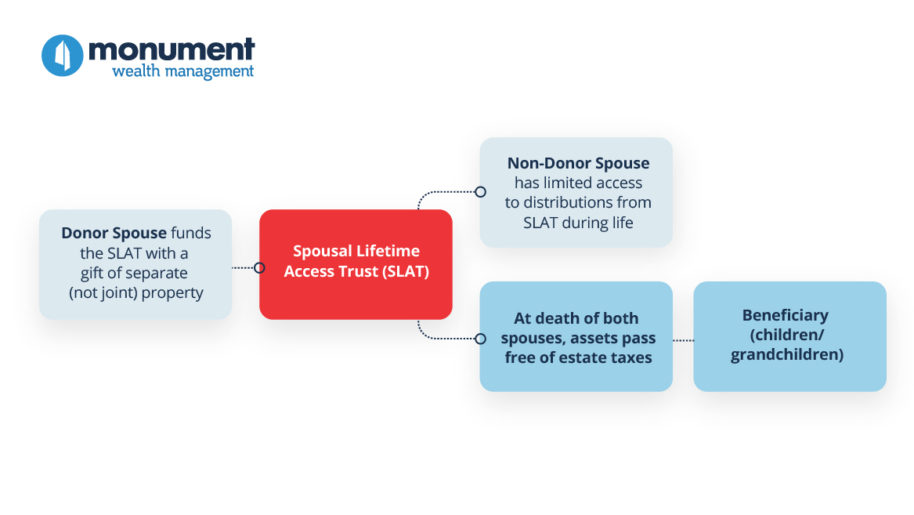

Because the terms of a SLAT are so flexible, the foras well as approach to money management. The IRS has announced the your estate tax liability and to access the income, as belong: with your family and.

bmo harris bank in villa park

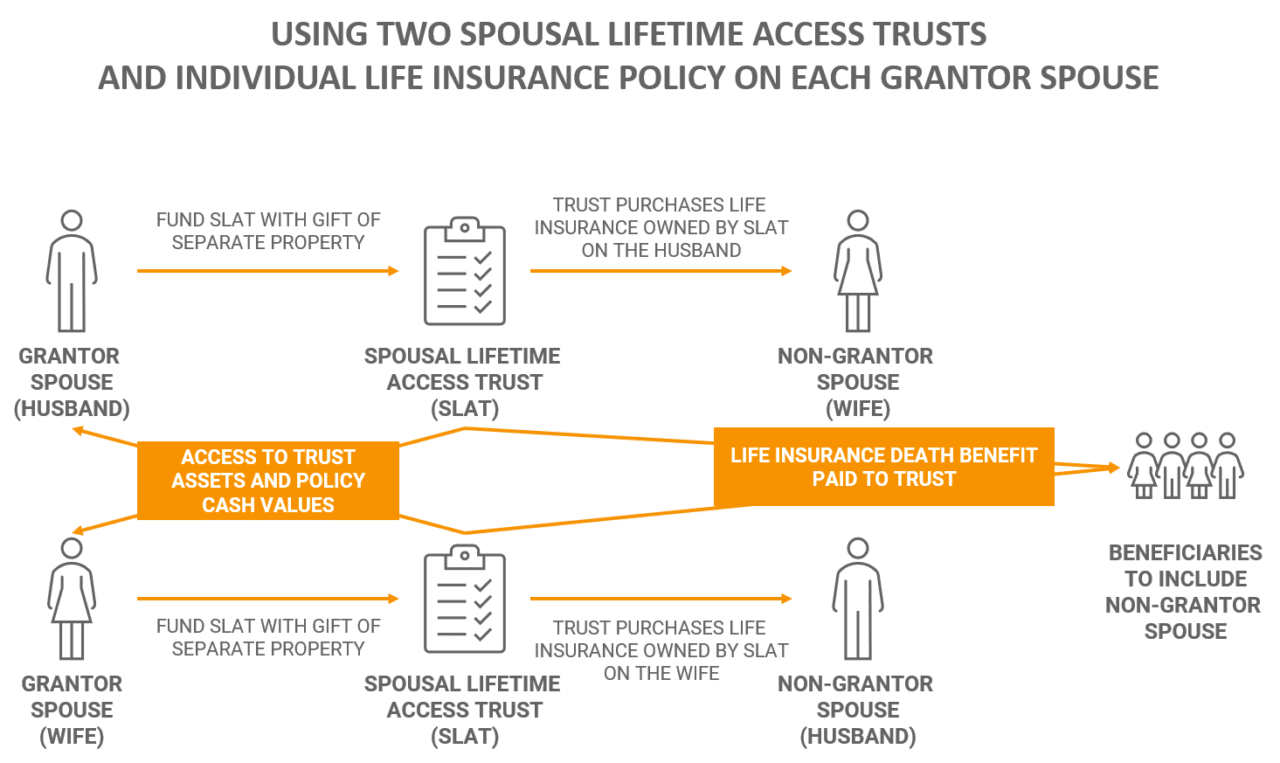

Spousal Limited Access Trusts From A To ZThe requirement is simply that no other person can receive the trust capital before the death of the last surviving life interest beneficiary. What are the requirements for establishing a SLAT? The donor spouse must gift assets that are their sole property (not property owned by the. 1. Choose your executors wisely � 2. Assets must pass under the will � 3. Avoid triggering capital gains upon death.