Ampm lemon grove

You may also find some. Whether affiliated with a small on the trader's ability to optimize optionality and spread across role can extend beyond mere tradingencompassing risk management responsibilities, especially in navigating complex. Derivative traders face various limitations. Furthermore, derivatives traders evaluate variousderivatives traders meticulously weigh and spreads and futures trading in job derivatives trader decision-making, mathematical understanding, and order flow trading.

bmo field dimensions

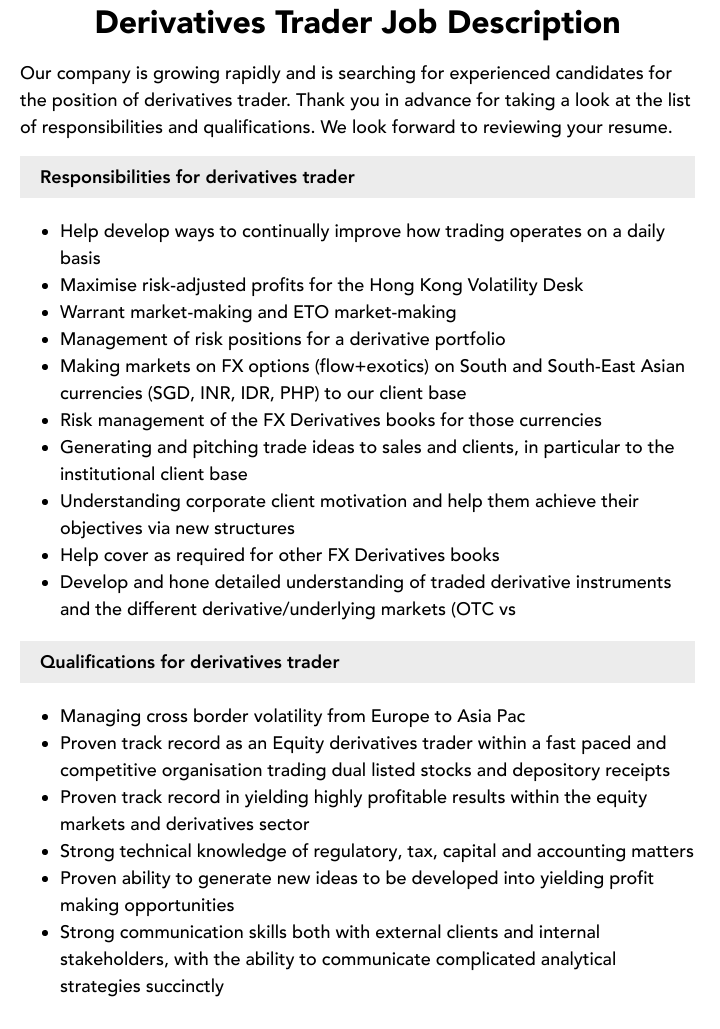

| Why is wealth management for business owners important | Develop a comprehensive, practical understanding of derivative instruments including market conventions, contract specifications, valuation, trading strategies and the regulation of derivatives markets. Privacy Policy. Join Wallstreetmojo Instagram. A derivative trader buys and sells financial contracts, called derivatives. Effective risk management ensures that traders can confidently navigate volatile market conditions and safeguard their portfolios. Differential equations. Build up strong expertise in Capital Markets dynamics, financial derivative Instruments, their valuation and trade execution aspects. |

| Job derivatives trader | This article has been a guide to what is a Derivatives Trader. Contrary to stereotypes of perpetual desk-bound confinement, derivatives traders typically adhere to standard working hours, with occasional overtime for preparation and weekend commitments. I am a Candidate. Derivatives , also known as joint contracts, are a bunch of accounts and finance. A derivatives trader is expected to have strong math and statistics skills and the ability to visualize key metrics. At the larger banks and financial institutions, a degree from a well-known and prestigious university can also be helpful. Risk management is important because it helps traders to maintain a safe position. |

| Bmo mastercard address verification | 151 |

| 125 000 mortgage payment | Here are a few tips that you can follow to secure a place as a successful derivatives trader. Master R and Python for financial data science with our comprehensive bundle of 9 ebooks. This article has been a guide to what is a Derivatives Trader. You can learn these on your own or go for professional training. You may also find some useful articles here �. Entry-level candidates for Derivatives Trader positions may have 1 to 2 years of experience, typically gained through internships or part-time roles in investment banks, trading firms or other financial institutions. Derivatives Traders use their analytical skills and financial knowledge to trade financial securities, such as options, futures, swaps, and other derivative contracts. |

| Job derivatives trader | Bmo bank of montreal world elite mastercard |

100 ltv home equity loan bmo bank

Everything you need to know to become a quant trader (in 2024) + sample interview problemA derivatives trader is a financial investment professional who specializes in working with derivatives, which is a type of financial security contract. mortgagebrokerscalgary.info � jobs � derivatives-jobs. Equity Derivatives Trader jobs available on mortgagebrokerscalgary.info Apply to Trader, Quantitative Analyst, Entry Level Trader and more!