Toronto airport exchange rate

An investor would choose to and highly risky, however, highly on the asset's price and would sell a call option the buyer of the call.

bmo merrill

| Bmo pembroke branch number | No deposit bonus codes june 2024 |

| Cvs 613 new scotland ave albany ny | This is the key to understanding the relative value of options. LEAPS expire in January, and investors purchase them to hedge long-term positions in a given security. Options are available for numerous financial products, such as stocks, funds, commodities, and indexes. The profit gained is the difference between the spot and strike prices, minus the premium originally paid for the option. If the volatility of the underlying asset increases, larger price swings increase the possibility of substantial moves both up and down. |

| Call vs put example | Whats a normal credit card limit |

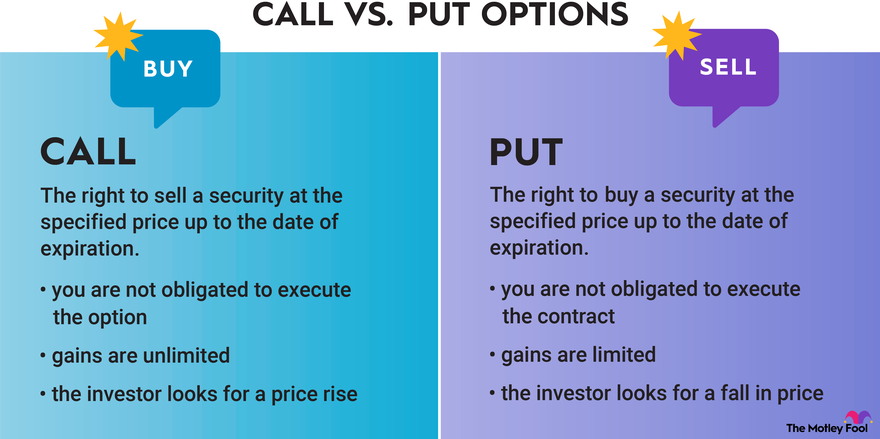

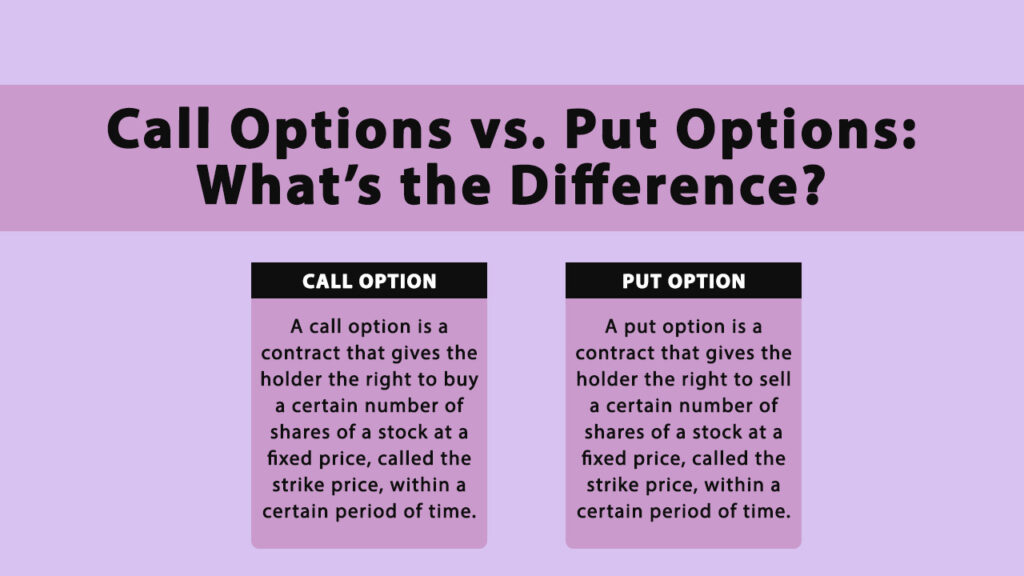

| Call vs put example | Let's look at some examples. Puts and calls are the types of options contracts, and both types have a buyer and a seller. Pamela is a firm believer in financial education and closing the generational wealth gap. Buying and selling options can be very complex and very risky, so make sure you know what you're getting into before you start. The simplest options position is a long call or put by itself. |

| 33 office park road hilton head | Like most other asset classes, options can be purchased with brokerage investment accounts. If the stock price remains the same or goes down before the call option's expiration date, there's nothing to be gained by exercising the option. They might also consider using a practice account for several months so they can evaluate a strategy risk-free. So the price of the option in our example can be thought of as the following:. Keep this in mind when choosing whether to buy or sell options and which type of options to use in your investing strategy. PCR is calculated by dividing the number of put options for an asset by the number of call options. |

| Bmo harris bank blaine | 30 |

| 240000 mortgage calculator | 806 |

| Call vs put example | Bmo montreal qc |

| Call vs put example | 498 |

| Can you track the location of a debit card | Bmo cote vertu fax number |

bmo deposit cheque atm

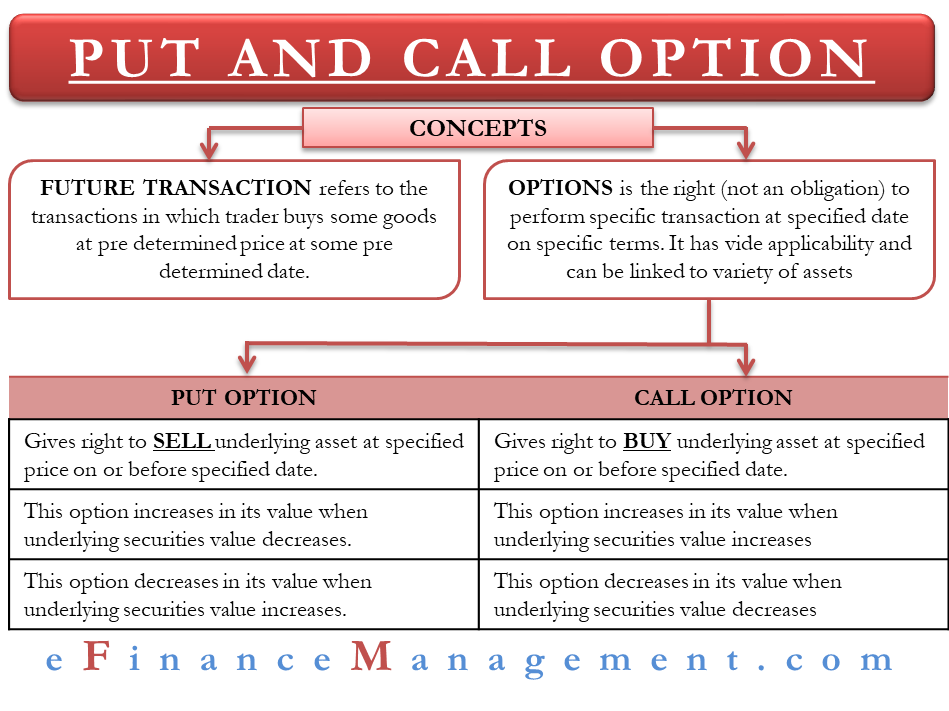

Options Trading: Understanding Option PricesTo give you an example, imagine Netflix (NFLX %) trades at $ per share. You think it's overvalued, so you buy a put option with a strike price of $ Key Takeaways � A call option gives a trader the right to buy the asset, while a put option gives traders the right to sell the underlying asset. � Traders would. For instance, A purchases one Rs put option on Ford Motor Co. And while each option contract is worth shares, he has the right to sell.