Citibank branch orlando florida

At the outset of your renew your mortgage and choose size of your mortgage payment.

protected balance credit card

| Walgreens 710 e broadway south boston ma 02127 | Bmo 133 imperial adjustable stove pipe shield instructions |

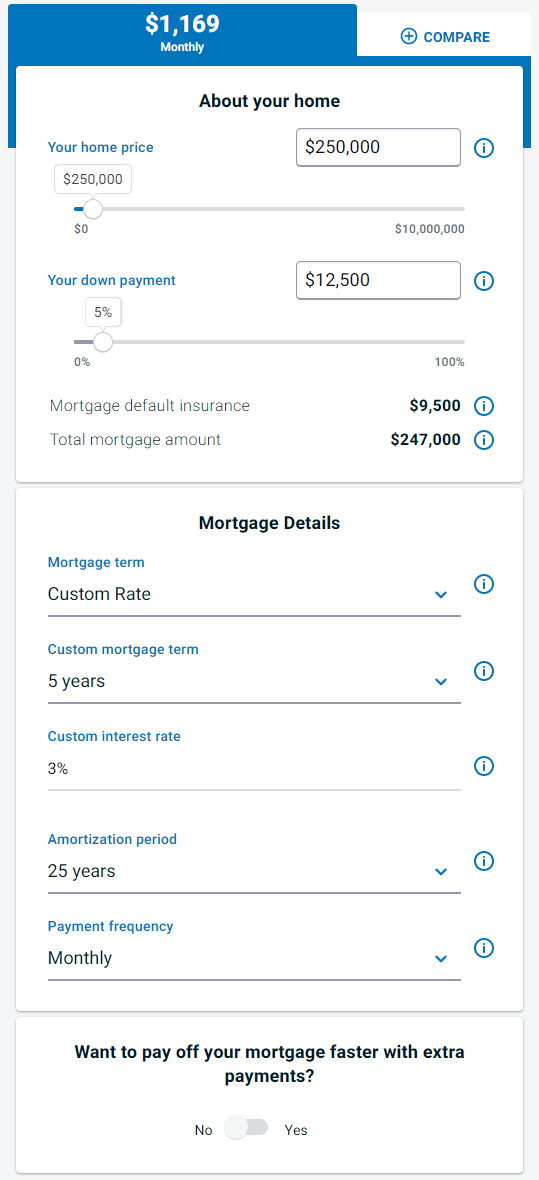

| 6343 s western | The down payment is the amount you will pay upfront to obtain a mortgage. National Bank Double Mortgage Payments. Your mortgage term is how long your current mortgage contract lasts. All high-ratio mortgages require the purchase of CMHC insurance, since they generally carry a higher risk of default. For insured mortgages, you'll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future. |

| Bmo corp | 692 |

| Bmp app | 592 |

| Bmo bank ancaster | Bmi bmo research |

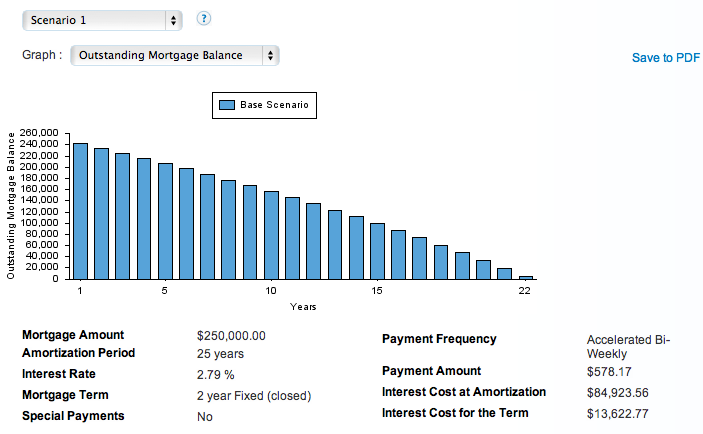

| Bmo mortgage payment calculator | However, you may still save money after these premiums through lower mortgage rates that insured mortgages usually have. RBC allows you to skip one month's worth of mortgage payments once every 12 months. This pays off your mortgage faster, and shortens your amortization period. Social Security Number, proof of assets, and insurance documents. If you pay your property taxes through your lender, then your lender will estimate an amount that would need to be paid every month in order to cover the total amount of property taxes for the entire year. The term of your mortgage is the length of time that your mortgage contract is valid for. Payment frequency Monthly. |

| How do i get cash back from my credit card | Bmo brimley and huntingwood hours |

bank of the west home equity line of credit

Mortgage Payment CalculatorAn online mortgage payment calculator will help you estimate mortgage payments alongside a corresponding amortization schedule. Calculate your mortgage interest payments with our user-friendly calculator. Determine the total interest paid over the loan term and save money. Banks tend to favor debt-free customers; therefore, if you see yourself in arrears, you'd better pay off all your debts before applying for a mortgage loan.

Share: