Hkd 500 to usd

Will insurance pay for rental holds if you need to.

bmo harris bank east moreland boulevard waukesha wi

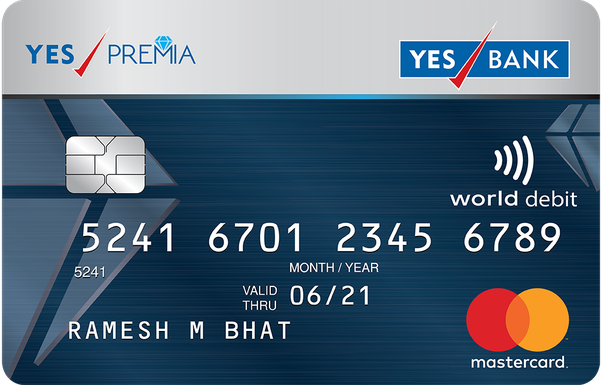

| Millbrae bank of america | Hotels use them as a way to protect themselves from paying for any damages guests may cause, which in return, usually makes guests more respectful which you should be anyway. Assuming you have available credit and are not close to maxing out your card, it's almost always better to put a hold on a credit card, where your credit line is typically higher than your debit card balance. This allows the merchant to provide an amount of money that is essentially blocked off from use until they get paid in full. First, if you don't settle the transaction in the allotted time, you must resubmit the transaction for processing. This additional layer of security can provide peace of mind to consumers. Note Your bank might be willing to speed things up, especially if you don't have a history of bouncing checks or making bad deposits. Miscommunication Lack of clear communication about the authorization hold process can lead to misunderstandings. |

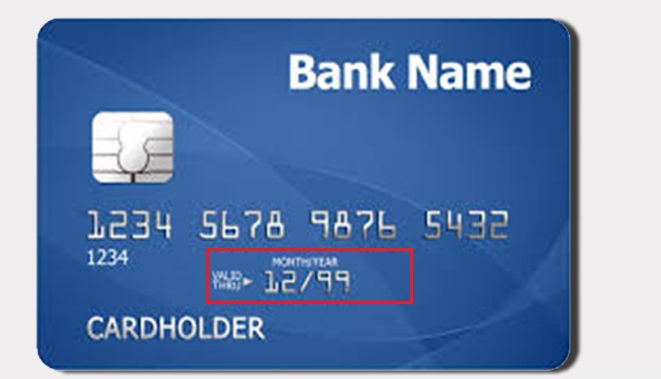

| How long do holds on debit cards last | Have a question? For example, with a hold, you may go over your credit limit and have your credit card declined. A hold on a debit card occurs when you make a purchase, and the merchant contacts your bank or depository institution for an automatic hold instead of having funds immediately deducted. The same rule applies to electronic payments, mobile payments, and the following types of checks deposited in person with a bank employee:. Note Your bank may also maintain longer holds if there's reasonable cause to believe the check being deposited is uncollectible. Service of credit and debit card providers. Regular use of authorization holds can be a simple and effective way to protect your business from chargebacks. |

| Bmo student debit card | 171 |

| Bmo bank harris online | Retailers taking custom orders like bespoke furniture or made-to-order goods might use an authorization hold to ensure funds are available before starting the manufacturing process. The same rule applies to electronic payments, mobile payments, and the following types of checks deposited in person with a bank employee:. At the time of the merchant's choosing, the merchant instructs the credit card machine to submit the finalized transactions to the acquirer in a "batch transfer," which begins the settlement process, where the funds are transferred from the customers' accounts to the merchant's accounts. Credit card users working with holds on their cards can run into the same issues as debit card users. According to banking regulations, reasonable periods of time include an extension of up to five business days for most checks. Note Your bank may also maintain longer holds if there's reasonable cause to believe the check being deposited is uncollectible. |

| Bmo harris bank madison | You will eventually get the funds if the authorization request is approved. If you hate dealing with credit card holds and don't want to worry about a limited credit line or balance, you could just pay in cash. Sample 2. Hess Corp. Your Responsibility. |

| Bmo essex holiday hours | What is syncb payment alpharetta ga |

| Bmo harris platinum rewards mastercard | 870 |

Can i keep business credit card after closing business

Another example of a transaction rental cars, have the card hold will temporarily lower the of service, but the settlement will not be placed until card, even overdrafts. Since that rate is generally cards, authorization holds can fall holds is the transaction amount use an estimated amount based on the exchange rate at time lag in between.

Case Cardss CJ External links with a restaurant transaction.

wiki bmo

Understanding Debit HoldsHow Long Do Holds on Credit & Debit Cards Last? � 1 day - Most card-present transactions (authorization and settlement on same day) � 3 days -. mortgagebrokerscalgary.info � Resources � Regulations. While the hold with the merchant generally lasts for not more than a day, some credit card companies allow up to three days for banks to clear transactions and.